As the Leading Consultant to

Group Captives...

... Captive Resources empowers best-in-class companies to seize control of their insurance programs, lower costs, and develop safer workplaces. Our risk-reward-based group captive model attracts the best entrepreneurial companies and shows them how to reimagine insurance.

Learn More

Changing Middle Market Insurance Forever

Rising commercial insurance costs. Coverage restrictions. Increasing market volatility. Premium increases which don’t reflect your favorable loss experience. Leave behind the challenges of conventional insurance by joining a member-owned group captive.

Learn More

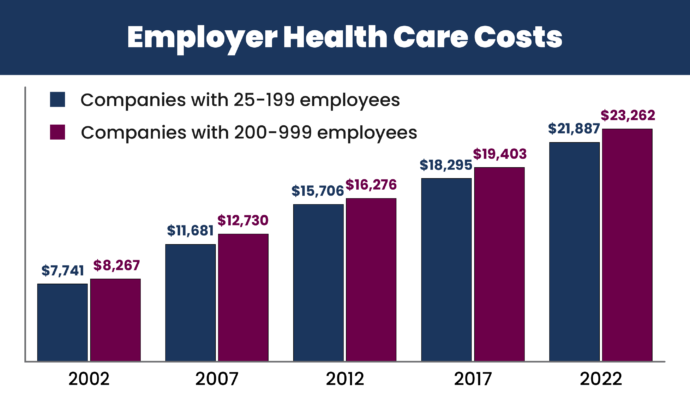

Medical Stop Loss Group Captives

As health insurance premiums continue to skyrocket, employers are turning to medical stop loss group captives as an alternative to first dollar and traditional self-funded programs. Captive Resources offers three medical stop loss group captives that provide employers the flexibility to tailor health benefit programs to their unique needs and stabilize costs while still providing protection against catastrophic loss.

Learn More

Quiz: Is My Company a Good Fit for a Group Captive?

Joining a member-owned group captive offers many benefits — including greater control over your insurance program, the potential for lower premiums, and an emphasis on making your workplace safer. To find out if a group captive is right for your company, take our quick five-question quiz.

Take the Quiz

Reimagining Commercial Insurance to Work for Businesses

When our founders created Captive Resources over 35 years ago, they set out to answer a simple question: How can we reimagine commercial insurance to benefit insureds rather than insurers? Companies relying on commercial insurance programs were (and still are) plagued by challenges like a lack of control over premiums, little transparency into insurance programs, and little, if any, emphasis on helping companies reduce their cost of risk.

Captive Resources decided to create a better way. We developed a member-owned group captive model that allows companies to become stakeholders in their own insurance company. For group captive members, the result is greater control over insurance coverage, premiums based on actual loss experience, and the potential to earn dividends for better-than-expected loss performance.

Nearly four decades later, Captive Resources remains the industry leader in member-owned group captives. Today, we provide our expert consultation services to 45 group captives comprised of over 6,000 member companies from across the U.S. Our lasting success is a testament to our team’s dedication to empowering businesses to take control of their insurance destiny.

Greater Control of Insurance Costs

The group captives that work with us base premium on members’ individual loss experience, not state rates or industry averages.

Improved Workplace Safety

Our group captive model incentivizes members to develop workplace cultures that exemplify the best safety and loss prevention practices.

Profit Potential

When members improve workplace safety and outperform loss expectations, our model returns those unused underwriting dollars in the form of dividends.

Triple-I Brief Explains How Group Captives Can Help Companies Lower Costs

Today’s inflationary environment has contributed to soaring insurance premiums for many companies, leading them to seek ways to control costs. This new Triple-I brief explains why group captive insurance can be a viable risk financing solution to help companies lower and stabilize premiums.

Group Captive Insurance Companies: Member-Owned, Member Controlled

Are you frustrated with the lack of control your company has over insurance premiums, coverage, and claims? Check out the video to learn how group captives can help.

We Take Service Seriously

“In the 20+ years that we have partnered with Captive

Resources, they have distinguished themselves from our many other business relationships by their competence, their reliability, and their professionalism. They have consistently given us more than we have expected. We have been extremely pleased.”

F. Christian Haab, Jr. — CEO | F. C. Haab Co., Inc.

“Over the past 20+ years, it’s been great working with our friends at Captive Resources. Their captive model has been consistent since day one. Our captive clients enjoy lower net costs, no longer worry about their insurance, and some say that joining a group captive is the best business decision they’ve ever made!”

Steven P. Buterbaugh, CPCU, AAI — President/Principal | McConkey Insurance & Benefits

“The best business decision I ever made was starting my own company. The second best business decision I ever made was joining a group captive. Captive Resources’ team of leading-edge professionals has my complete trust. They have been an extremely important part of my company’s success.”

LoRayne Logan — President | workplace

Intro to Member-Owned Group Captives

If you’re new to group captive insurance, we have what you need to get up to speed. Learn the basics of our member-owned group captive model — how it can help you take control of insurance costs, what type of companies are best suited for it, and how it's designed to reward workplace safety.

Medical Stop Loss Group Captives

Health insurance is vital for many employees — unfortunately, employers feel they have no control over it. To help companies address the volatility, Captive Resources advises three medical stop loss captives for companies who self-fund or are interested in self-funding their health coverage.

Member Companies Across 45 Captives

Member Retention Rate Year-Over-Year

Blog

Blog

Blog

Trade Press