If you've noticed a disturbing upward trend in your company's insurance premiums, you're not alone. A recent report from The Council of Insurance Agents & Brokers (CIAB) showed just how much impact the ongoing hard market continues to have on commercial insurance premiums.

According to the CIAB's Commercial Property/Casualty Market Index Q1 2021, premiums were up an average of 10 percent across all account sizes and all lines of business. Here are a few other key findings from that report:

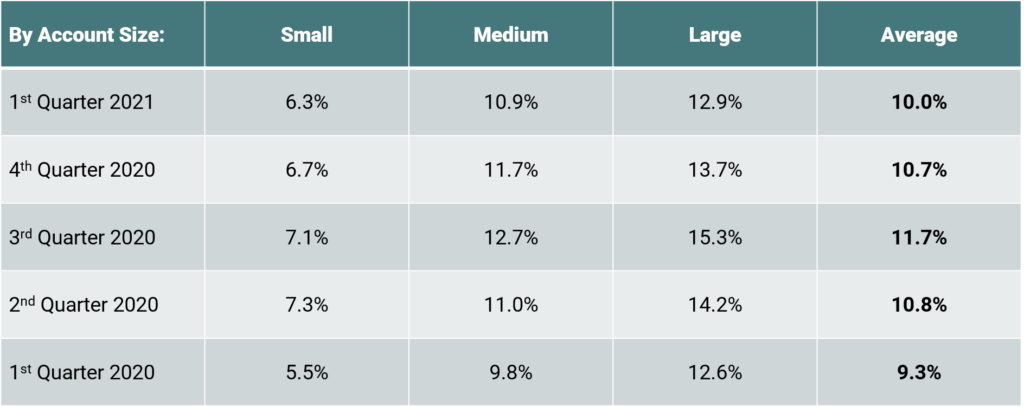

While the rise of commercial insurance premiums pre-dated the outbreak of COVID-19, the pandemic highlighted the volatility of the market. Here's a look at the average premium increases by account size since the start of 2020.

For more information, check out the full report on the CIAB's website: The Council of Insurance Agents & Brokers’ Commercial Property/Casualty Market Report Q1 2021.

While rising commercial insurance premiums are a significant and reoccurring challenge in the conventional market, they also represent an opportunity for brokers and insureds. In fact, the inherent difficulties of a hard market (market uncertainty, uncontrollable pricing, etc.) are precisely why Captive Resources' (CRI) founders created our member-owned group captive model — which is an excellent fit for best-in-class companies regardless of market conditions. Member-owned group captives allow insureds to take control of their premiums by becoming owners of insurance companies, rather than buyers of insurance policies.

For more insights into this topic, check out our article from earlier this year: Why Group Captives are Especially Attractive in a Hard Insurance Market.