With the latest CIAB report showing significant, sustained increases in commercial insurance premiums, learn why now is an excellent time for insureds and their brokers to consider member-owned group captive insurance.

Commercial insurance premiums increased for the 15th consecutive quarter, according to The Council of Insurance Agents & Brokers (CIAB). For those of you counting at home, that’s nearly four straight years of pricing increases.

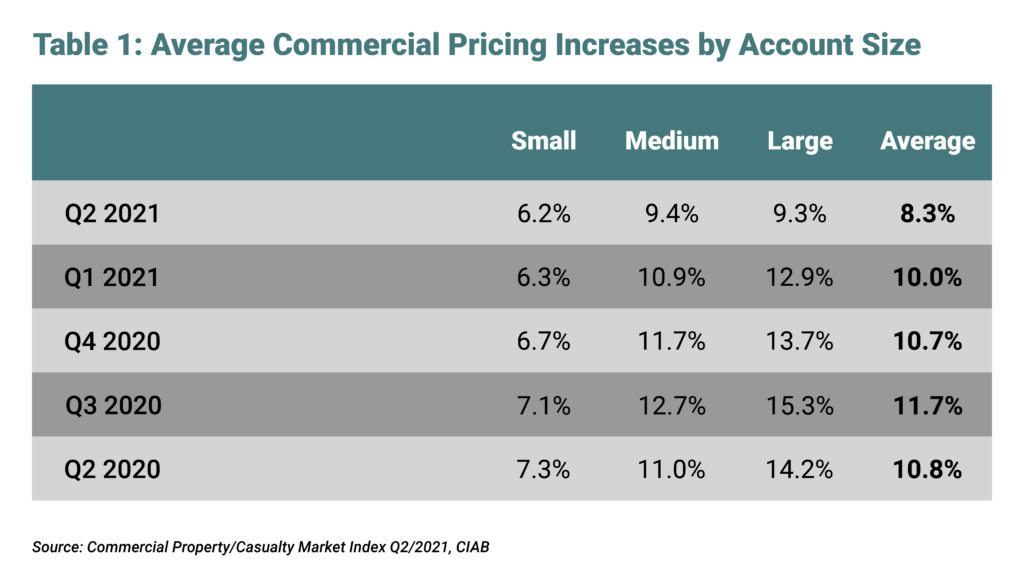

These numbers are courtesy of the latest Commercial Property/Casualty Market Report Q2 2021, which uses data from the CIAB’s broker members. According to the report, premium increases are up across all account sizes, with an average increase of more than 8 percent.

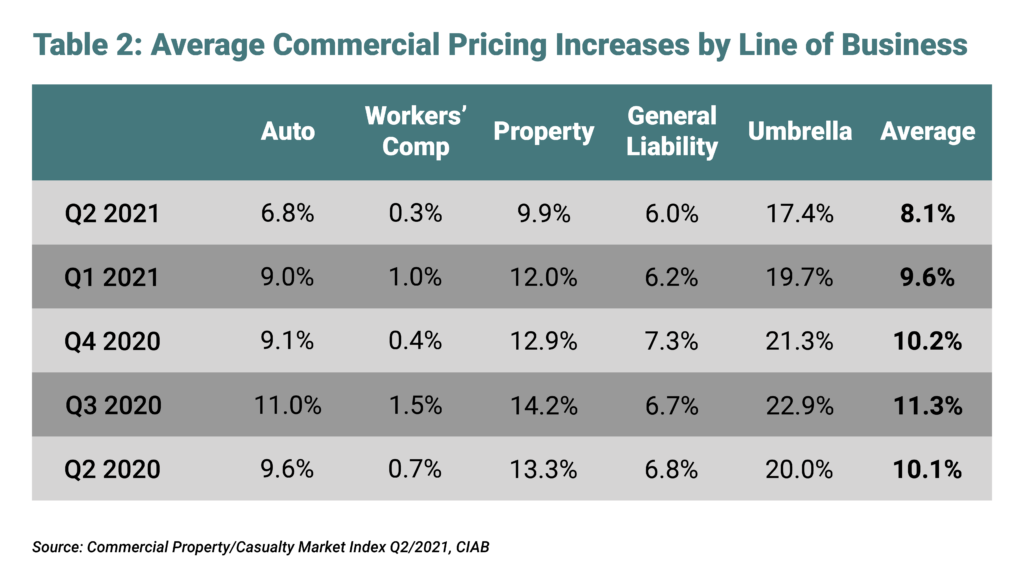

The premium surges weren't limited to specific coverages either, as all lines of business increased for the fifth consecutive quarter. Table 2 below shows the rate changes across the five major lines during this period. While prices moderated in Q2 compared to recent quarters, major lines saw significant increases, including Cyber and Umbrella — which increased by more than 25 percent and 17 percent, respectively.

Based on this report, it would seem like the commercial insurance industry is hitting a particularly onerous patch of what has already been a prolonged hard market. While hard insurance markets pose a significant challenge, they also represent an opportunity for insureds to extract themselves from the volatile conditions for good.

We’ve written about the opportunity group captives present in a hard market before. This latest report emphasizes those previous points — most notably the impact pricing increases will have on companies with better-than-average loss experiences.

“In this market, carriers are trying to capture rate increases across casualty lines,” said Mike Foley, President of Captive Resources. “This often leads to execution error, where attractive risks get swept up in the rate wave and experience unnecessary rate increases. Many accounts with excellent loss experience will be presented with significant rate increases, due to the market cycle.”

The group captive model utilized by the captives we support helps insulate members from the volatility of hard markets thanks to foundational components like:

To learn more about how group captives can benefit your company or your clients, especially in a hard market, contact Captive Resources today.