As 2021 kicks off, it looks like we can officially add another item to the pandemic’s growing list of second and third-order effects: a rapidly hardening insurance market. While the foundation for this current hard market existed pre-COVID, the economic hardships created by the pandemic have seemed to hasten its arrival in force. These economic conditions may even exacerbate and prolong the hard insurance market we find ourselves in today.

While hard insurance markets pose a significant challenge for conventional insurance programs, they also represent an opportunity for brokers and insureds. In fact, the inherent difficulties of a hard market (market uncertainty, uncontrollable pricing, etc.) are precisely why Captive Resources’ (CRI) founders created our member-owned group captive model — which is a great fit for best-in-class companies regardless of market conditions. Rather than a predicament, we see the situation as the perfect opportunity to work with our broker partners to help their clients find a more stable insurance option.

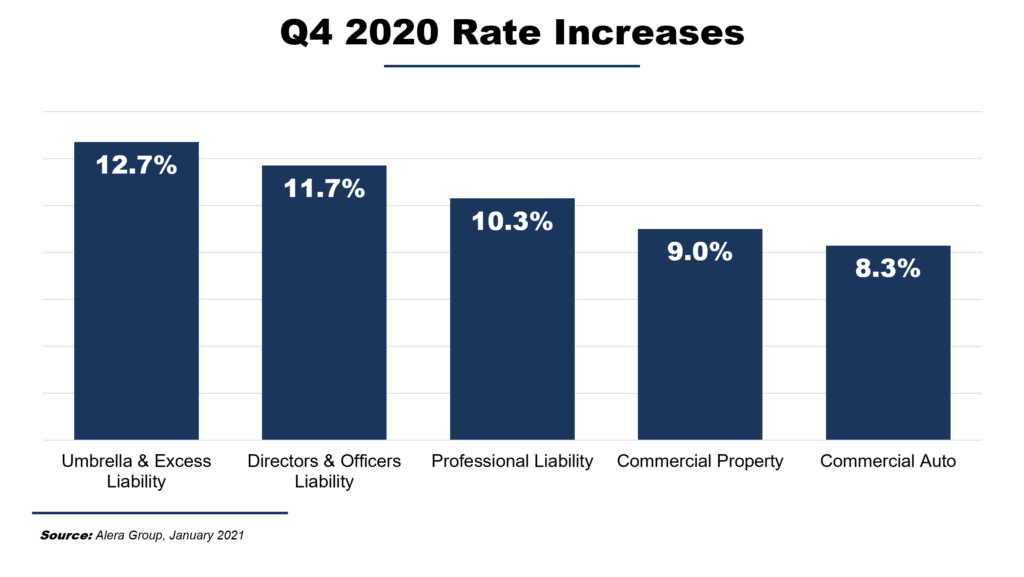

Following a 6.3 percent increase in the third quarter, U.S. commercial insurance rates jumped another 7.1 percent in the final quarter of 2020, according to MarketScout Corp. The rate hike was almost entirely across the board, with prices soaring across several major lines of coverage.

While the rate increases impacted companies of varying size and industry, medium- and large-sized insureds experienced the most extensive hikes. Rates on medium accounts (those paying between $25,001 and $250,000 in premium) and large accounts (those paying between $250,001 and $1 million in premium) increased 8.3 and 9.3 percent, respectively. Industries bearing the brunt of these rate increases included transportation (11.5 percent), habitational (9.5 percent), and contracting (7.3 percent).

“While COVID-19 certainly exacerbated things, conventional insurance rates have been on the rise for a few years now,” said CRI’s Chief Marketing Officer John Pontin. “Before COVID, factors like reductions in market capacity, serious losses in the catastrophic and reinsurance sector, and lower investment returns were already causing the conventional market to harden.”

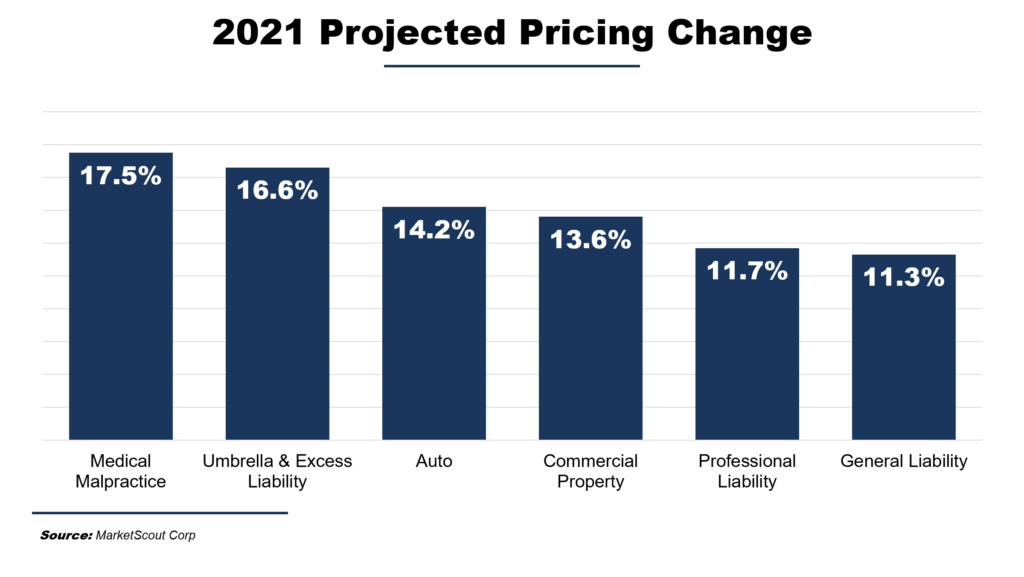

Unfortunately for insureds and brokers alike, the hardening market doesn’t appear to be going away in the new year.

“2021 promises to be a challenging renewal year for companies with conventional insurance programs. Regardless of loss records, very few insureds will see their premiums renewed as is,” said Pontin.

Industry research backs up Pontin’s assertion. According to a recent study from Alera Group, rates will go up 11.6 percent on average in 2021, buoyed by substantial price increases across nearly every line of commercial coverage.

“In this market, carriers are trying to capture rate increases across casualty lines,” said Mike Foley, President of CRI. “This often leads to execution error, where attractive risks get swept up in the rate wave and experience unnecessary rate increases.”

“Many accounts with excellent loss experience will be presented with significant rate increases, due to the market cycle.”

For brokers and insureds, the hardening market presents the perfect opportunity to explore the benefits of member-owned group captives. The companies that are best suited to thrive in a group captive share characteristics like:

Joining a group captive can help insulate companies from the ebbs and flows of the traditional commercial insurance market.

“To the extent that market pricing is moving upward due to underlying loss dynamics for the industry, group captive rates may ultimately move upward to some extent, but at a much slower pace,” Foley said. “The pricing will be much more predictable, and the customer will understand the key driver of their insurance cost is their individual loss experience — which they can control.”

Group captive members are able to enjoy more stability and predictability than conventional market insureds, due to several foundational components of CRI’s model:

“For companies that focus on loss control and having a safe workplace, group captives typically lead to very attractive pricing at any point across the commercial pricing cycle,” said Foley. “This is particularly true when rates are increasing across the board for the industry.”