Recent insurance premium statistics from the Council of Insurance Agents & Brokers (CIAB) confirm the durability of the current long-term hard insurance market. The CIAB’s Commercial Property/Casualty Q2 2023 Market Index Report makes a strong case for looking outside the traditional market to alternative risk transfer methods.

Group captive insurance is an alternative worth exploring for companies prioritizing workplace safety but still facing consistent premium increases. We’ll cover some of the inherent cost-control features of group captive insurance here. First, though, let’s look at the premium trends from the CIAB report.

The full Commercial Property/Casualty Q2 2023 Market Index Report is available on CIAB’s website.

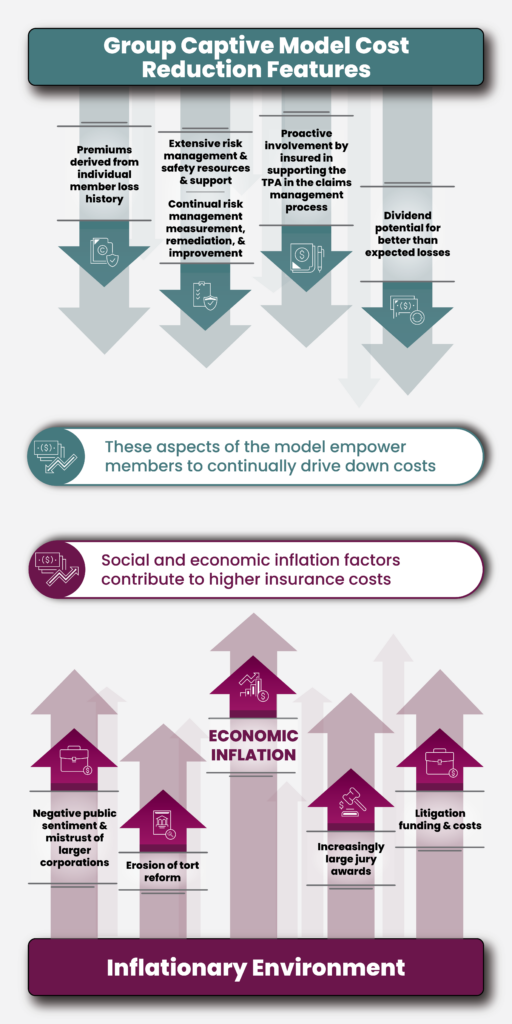

For many companies, group captive insurance can offer a promising option in an otherwise bleak insurance market. The member-owned group captives we support have inherent features designed to enable already safety-conscious companies to reduce their overall cost of risk amid upward cost pressures driven by inflation and other factors.

A recently published Executive Brief from the Insurance Information Institute (Triple-I) reveals how the cost-control features of group captives give member-companies opportunities to buck the long-term insurance premium growth trend.

Ultimately, the distinguishing factor is control: Group captive insurance offers companies more opportunities to control insurance premiums than traditional plans, which is especially beneficial in hard markets. According to the Triple-I Brief, group captives “can provide a viable way to protect companies across several lines of casualty insurance. Their prominence is likely to grow as economic and litigation trends continue to increase costs, prompting companies to continue to seek effective risk financing programs offering superior cost control.”

The full Triple-I Executive Brief Group Captives: An Opportunity to Lower Cost of Risk provides a complete overview of the benefits of group captive insurance.