Safety-Conscious: In our group captive model, member-companies are stakeholders in their own insurance company, which gives them added incentive to lower costs by managing risk and improving workplace safety. The group captives we work with accept only safety-conscious companies committed to continuous improvement, and we provide extensive resources to support their efforts.

Captive Resources’ (CRI) member-owned group captive model works well for companies from an array of industries and of various sizes, but it’s not for everyone. The group captives that CRI support admit new members carefully to ensure they’re sharing risk with other best-in-class companies similarly motivated to control costs and continuously improve.

The companies that find the most success in our model share common attributes, both in terms of their psychological approach to insurance and their business profiles. Scroll down to see if your company may be a good fit.

Behaviors and Mindset

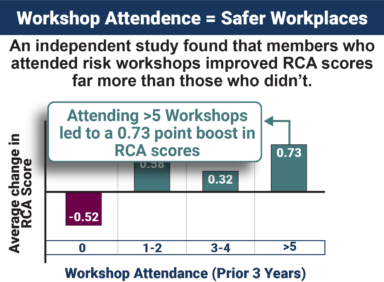

Accountable: The group captives we work with take a big-picture approach to risk management. For our members, this means going beyond standard safety procedures and taking an active role in managing and measuring risk. Successful members regularly attend risk management workshops, undergo risk control assessments (RCAs)*, and implement the latest methods and systems to make their companies safer.

Entrepreneurial: Group captive members aspire to the mantra “What you put in, is what you get out.” Joining a member-owned group captive allows your company to exert control over coverage decisions, claims processes, risk management, and more. The group captive members that find the most success in our model share entrepreneurial qualities — they’re motivated, forward-thinking, assertive, innovative, and embrace the risk-reward trade-off.

Business Profile

While there isn’t a single, ideal profile for the companies that join a member-owned group captive, organizations with the following qualities typically find the most success in our model:

- Long-term financial strength and stability.

- Management teams committed to safety, with solid safety programs in place.

- Loss histories that are better than average for their respective industries.

- Annual casualty premiums of at least $250,000 (minimum of $100,000). Many group captive members have premiums between $1 to $5 million, with some as high as $25 million or more.

A Diverse Range of Industries

The member-owned group captives we work with have member-companies from a wide variety of industries. Here is a sampling of the industries we work with:

*The Risk Control Assessment (RCA) is a risk control best practice tool developed by CRI to provide member companies with an in-depth review of risk management policies and procedures compared to industry best practices. The tool is also used to identify the captive member’s areas of strength and deficiency.