Over the last couple of months, we released a series of need-to-know facts about our Medical Stop Loss group captive model. Below, you will find a summary of these facts, along with some additional resources to help you better understand the benefits of our Medical Stop Loss group captive insurance models.

Captive Resources currently supports multiple Medical Stop Loss group captives to meet the various needs of companies looking for alternatives to first-dollar health insurance and traditional self-funded health insurance programs.

Before we dive into more about Medical Stop Loss group captives, let’s start with the basics: what is Medical Stop Loss insurance coverage?

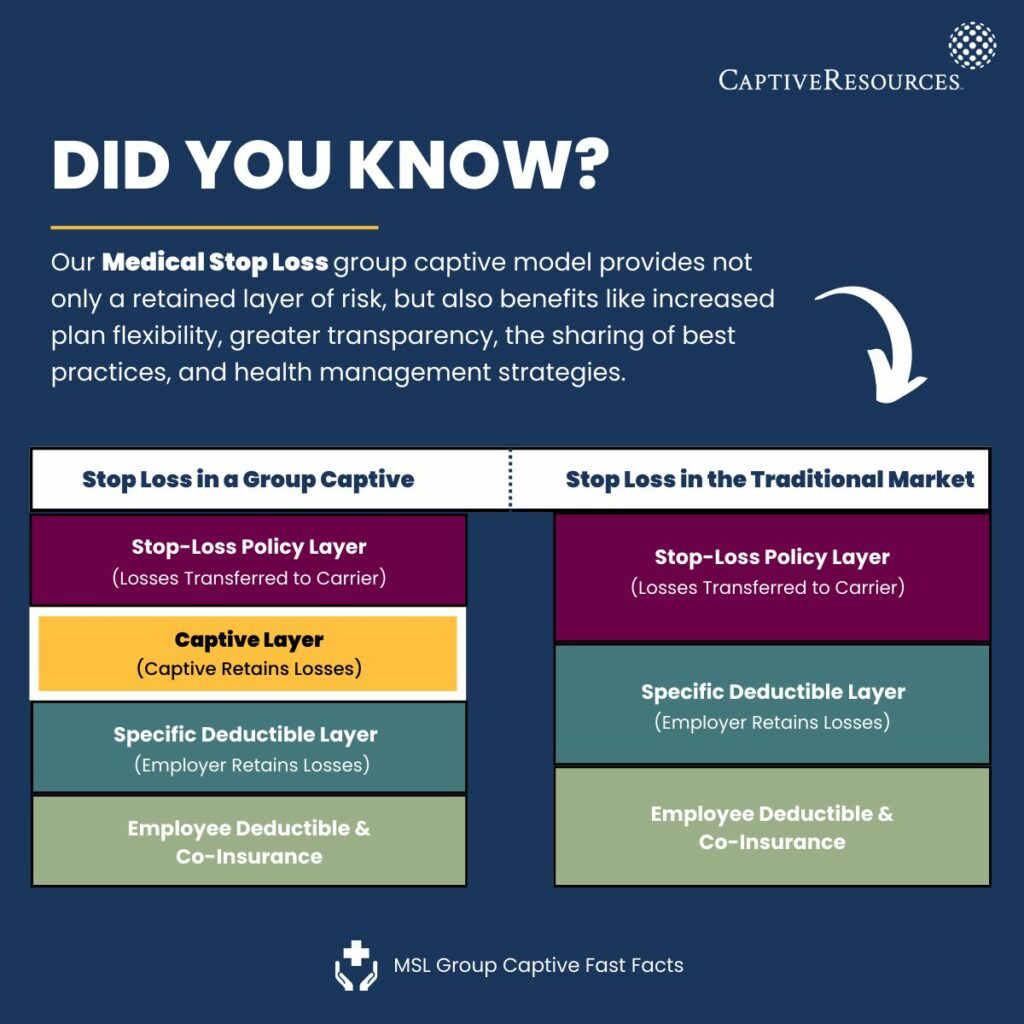

Our Medical Stop Loss group captive model allows self-funded employers to retain a layer of protection, and offers several additional benefits further differentiating it from the traditional self-funded market.

The captive adds a retained layer between the employer's selected retention and the excess reinsurance (stop loss) layer. Employers can choose from a wide range of specific deductibles to meet their individual needs. See the table below.

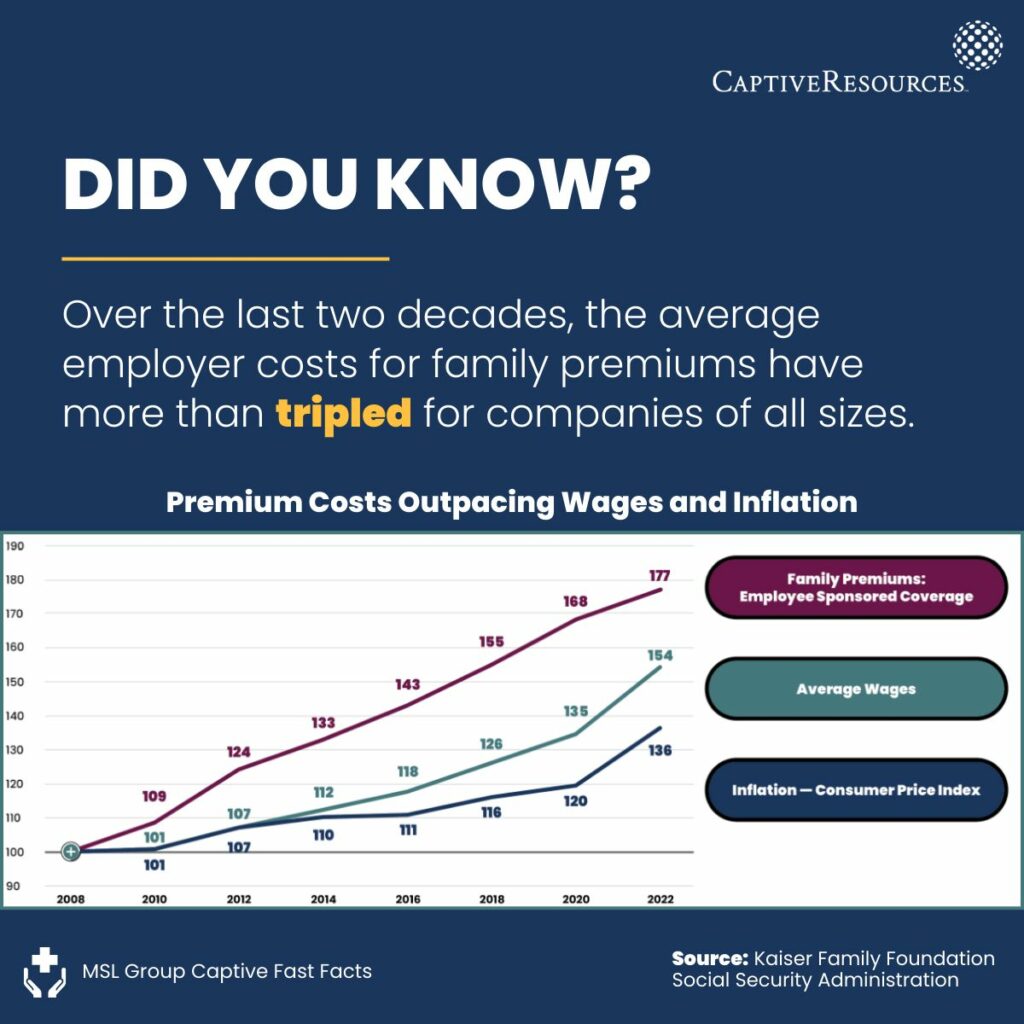

Healthcare costs are growing significantly faster than average wages and inflation. For most employers, healthcare is the fastest-growing operating expense, and one that they feel they have little ability to control.

As healthcare costs continue to rise, employers are increasingly looking to Medical Stop Loss group captives for stability, program flexibility, health risk management strategies, cost transparency, and the potential to earn dividends – all leading to control of their healthcare spend.

Quality health insurance is a crucial benefit that employers must provide if they’re to offer employees a competitive benefits package and attract and maintain top talent. A Medical Stop Loss group captive can help employers maintain, and even improve their current health insurance offering.

For years, larger companies have turned to self-funded plans to take charge of their health insurance programs and gain control over their overall healthcare costs. According to data from Kaiser Family Foundation, while almost 90% of large companies are self-funded, less than 61% of mid-sized companies self-fund, and only 30% of small companies self-fund.

Medical Stop Loss group captives allow companies of various sizes to experience the increased control of a self-funded program without having to go it alone.

Captive Resources currently works with four different Medical Stop Loss group captives. Three of those captives utilize a risk/reward model designed to benefit members for good individual performance.

We work with the captives to bring innovative, cutting-edge solutions and best practices to help members expand their health risk management strategies and contain costs while still providing high-quality care to their employees.

Employers that join one of the Medical Stop Loss group captives we support enjoy significant flexibility in how they structure their health benefits plan and what providers they partner with. Rather than being wed to a single carrier, a member-company can choose the service providers that best meet the needs of the organization, its employees, and their families.

Captive Resources helps coordinate and oversee these service providers in conjunction with our broker partners, working closely with them and the captive’s members to help ensure all functions operate effectively. We also help the captives to build long-standing, successful partnerships with best-in-class service providers, which has been one key to their success.

Medical Stop Loss group captives empower member-companies to implement effective cost containment strategies, which helps employers reduce spend while still providing their employees with superior medical benefits.

For example: By partnering with best-in-class service providers, Medical Stop Loss Group Captive members can creatively source medications and treatment for their employees at lower costs. Learn more about this solution in our case study.

Group captive membership also encourages member-companies to network and share innovative solutions with other like-minded companies, leading to better resources and education for the company and its employees.

When it comes to Medical Stop Loss captives, one size does not fit all.

The different Medical Stop Loss group captives we support have the versatility to fit the varying needs of employers. Check out the graphic below for more on how the different Medical Stop Loss programs help employers design a benefits program that can control costs while still providing exceptional coverage for their employees.

If you have any questions about Medical Stop Loss group captive insurance, please contact our team. We are always here as a resource to you!