Facing rising healthcare costs, many U.S. employers are looking for affordable solutions to provide coverage to employees and their families. Self-funding offers employers a way to control these soaring costs, but many small- to mid-size companies lack the scale to afford this option. Writing for Captive International, Joseph Parrilli — Senior Vice President at Captive Resources — explained how medical stop loss group captives offer these companies a viable solution to control these costs.

Here’s an excerpt from his piece:

Driven by continually rising healthcare costs, smaller and mid-sized companies are increasingly looking to leverage the benefits of self-funded plans. While many smaller companies lack the scale to completely self-fund their health programs, there is another way to achieve similar benefits. Medical stop-loss group captives, which allow smaller and mid-sized companies to combine their buying power to build self-funded health insurance programs as a group, have never been more popular.

Soaring Healthcare Costs

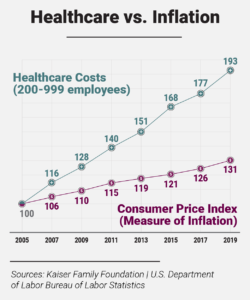

As healthcare costs continue to rise in the U.S., employers struggle with how to make coverage affordable for employees and their families. Cutting employee benefits or increasing employee contributions to their health care benefits have long been viewed as the only ways for employers to control health insurance plan costs. In recent years, the evolution of medical stop-loss group captives has allowed middle-market employers to regain some degree of control over these costs, which continue to soar and significantly outpace inflation in the middle market.

To learn more, check out the full article on Captive International’s website.