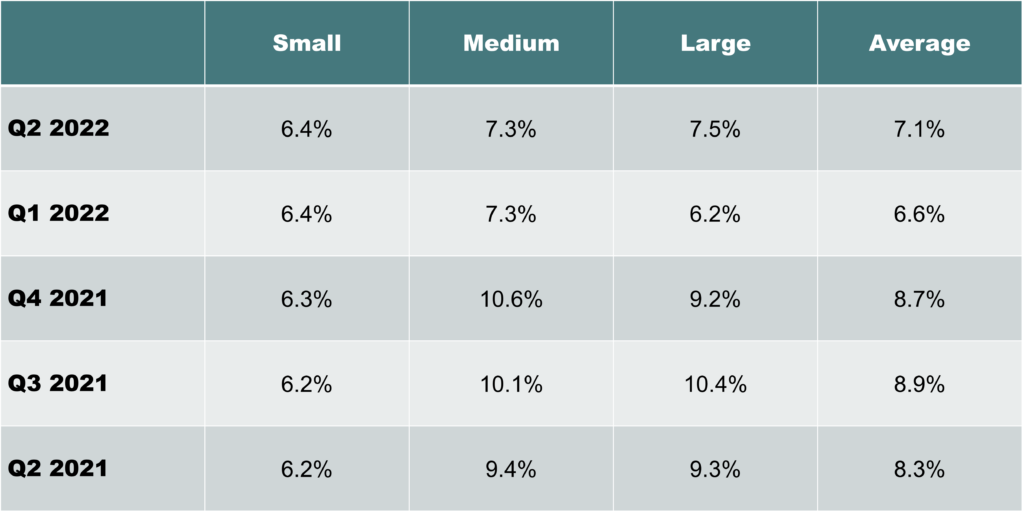

Driven in part by recent inflationary trends and weather-related issues, commercial insurance premiums increased by 7.1 percent in Q2 2022. This latest increase marked the 19th consecutive quarter of premium increases, according to the latest Commercial Property/Casualty Market Report from The Council of Insurance Agents & Brokers (CIAB).

Before we discuss the potential drivers of these pricing increases, let’s look at a breakdown of the numbers by account size and coverage line. In Q2 2022, the report from the CIAB showed premiums increasing in correlation with account size.

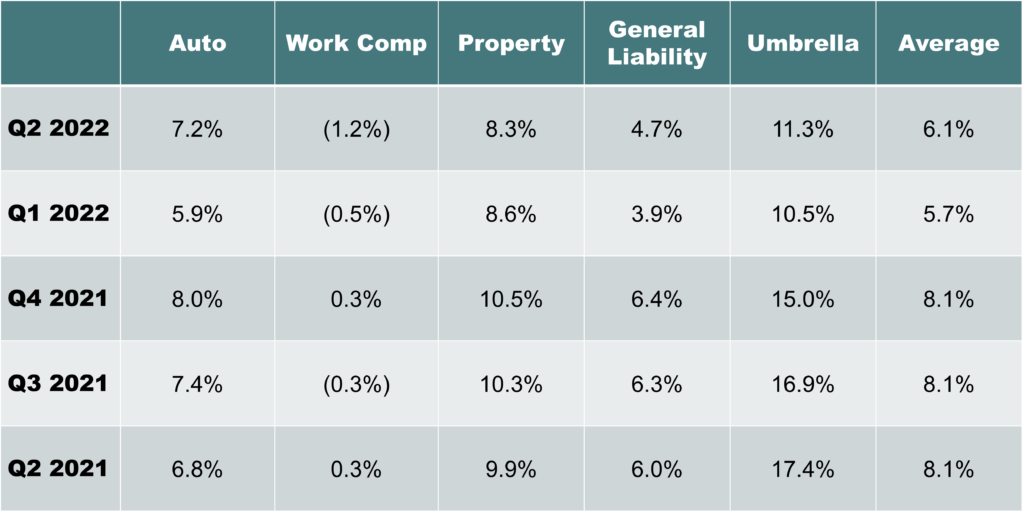

According to CIAB’s report, pricing increases varied across lines of business, with umbrella (11.3 percent), commercial property (8.3 percent), and commercial auto (7.2 percent) all seeing above-average increases.

While it's unfair to blame the current woes of the commercial market on a single factor, most of the study's respondents agreed that inflation had a negative impact on the market, especially on commercial auto and commercial property lines. As inflation inexorably drives up property valuations and the cost of materials, it adds upward pressure on premium prices for those coverages.

But it’s not just inflation that’s causing the rate increases. According to the report, weather plays a significant role as well:

Weather-related issues for property were so pronounced one respondent even said, “Hurricane season had a far greater impact [than inflation].” Indeed, as seen in [Exhibit II], premiums for commercial property did not increase significantly in Q2 2022 compared to Q1 2022, at an 8.3 percent average increase compared to 8.6 percent, respectively. At this point, it’s not quite clear how significant an impact inflation had in Q2 on this line, but what is clear is that it did have an effect since 75 percent of respondents agreed it did affect commercial property underwriting and pricing trends.

In the group captive world, hard market periods and rising inflation often drive increased interest. While it’s important to note that group captives should be considered more of a long-term approach to insurance than a short-term fix for rising prices, the group captive model does offer effective insulation from volatile market conditions. In a previous blog post, we discussed this dynamic with our co-CEO, Mike Foley.

“To the extent that market pricing is moving upward due to underlying loss dynamics for the industry, group captive rates may ultimately move upward to some extent, but at a much slower pace,” Foley said. “The pricing will be much more predictable, and the customer will understand the key driver of their insurance cost is their individual loss experience — which they can control.”

When it comes to the group captives that we support at Captive Resources, several foundational components protect member companies from fluctuating costs:

But perhaps the most influential component of group captives that protects members is the focus on risk control. Since group captives use companies’ actual loss history to determine premiums, members typically have much more control over costs.

“For companies that focus on loss control and having a safe workplace, group captives typically lead to very attractive pricing at any point across the commercial pricing cycle,” said Foley. “This is particularly true when rates are increasing across the board for the industry.”

Want to learn more about how joining a group captives can benefit your company? Contact Captive Resources today.