Welcome to the third installment of our Group Captives 101 series: “How does a captive insurance program work?” Click here to check out the first two articles in the series, which answer the questions "What is a Captive Insurance Company?” and “What is a Group Captive?”

Captive insurance has experienced historic growth in recent years. Today, there are more than 7,000 captive insurance companies globally, compared to just 1,000 in 1980. While this growth is impressive, captive insurance programs are still not as well understood as conventional insurance plans.

To help close the gap, this article will address the question, "How does a captive insurance program work?" To answer that, we’ll look at two fundamental components of a group captive insurance program:

This article will focus on how the group captives we work with typically (but not always) structure and fund their insurance programs. Keep in mind, there are several ways to operate a group captive, and the descriptions below may not apply to all captive insurance programs.1

In the context of the group captives that we work with, explaining the risk-reward formula used to fund losses is essential in answering the question “How does a captive insurance program work?”

Captive Resources developed the risk-reward formula in the 1980s, and it has grown to be the foundation of our group captive model. Equitable and easy to understand, the formula incorporates risk-sharing among the membership for severity losses and ensures that members' premiums reflect their risks and loss history.

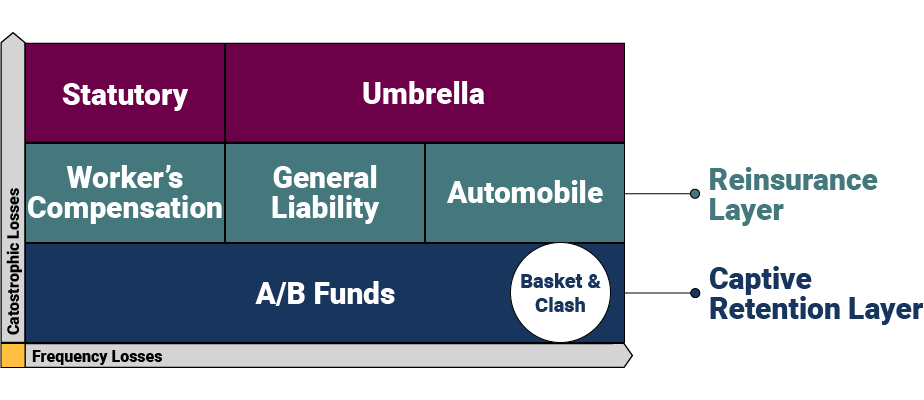

The funding formula is modeled around various layers designed to handle different levels of risk and protect members from catastrophic and aggregate losses. Here is a high-level visual representation of the formula and its layers.

In the captive retention layer, losses are the responsibility of the captive. This layer is comprised of two tiers: the A and B Loss Funds. The amount a captive retains varies based on the needs of each group but typically ranges from $250,000 to $500,000.

The captives utilize an independent actuary to project how much each member needs to contribute to its A/B Funds. The actuary uses the member's actual loss history to estimate how much the company will need to finance its yearly losses.

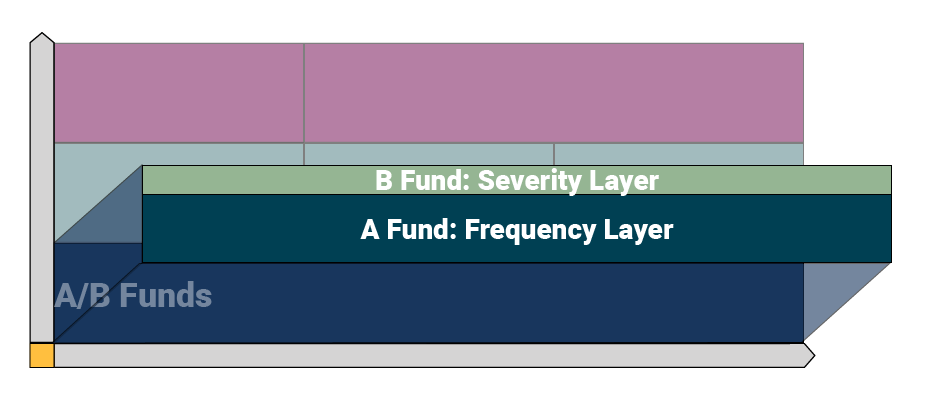

The group captives employ the A Fund as the "Frequency Layer" to handle smaller claims. The A Fund pays claims up to a certain cost level determined by each captive — for this article, we'll use $100,000 as an example. Functionally, this means that the A Fund will pay for claims between $0 and $100,000 per occurrence.

The B Fund represents the “Severity Layer," which handles larger claims. The B Fund pays for claims above the A Fund to a certain level determined by the captive. For this example, we'll use $400,000 as the ceiling for this layer, which means that the B Fund would handle claim costs between $100,001 and $400,000 per occurrence. The B Fund layer is where risk-sharing/shifting occurs, which means captive members share losses in this layer.

The captives typically also provide basket coverage (occurrences involving multiple lines of coverage) and clash coverage (two or more insureds suffer a loss from the same occurrence) for additional protection.

Above the captive retention layer is the reinsurance layer, where risk is transferred to a conventional insurance carrier across the various lines of coverage (e.g., workers' compensation, general liability, and automobile). Reinsurance protects the captive against catastrophic losses exceeding the captive retention up to a certain threshold — we’ll use $1 million for an example here. In our running example, that means the reinsurance layer will handle losses between $400,001 and $1 million.

The next layer is comprised of two elements:

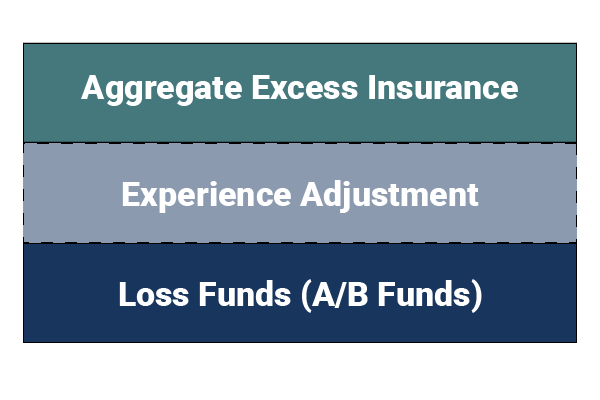

The layers above protect the captive against large losses, but what happens when a captive's members experience a large number of small claims? The captive purchases Aggregate Excess insurance to protect itself against unexpected frequency claims. So, in the unlikely event that the captive exhausts its loss funds, the aggregate excess would drop down and pay any additional claims in the captive retention layer.

The captives also have a built-in mechanism known as an "Experience Adjustment” — a preset dollar amount that each member is assessed if its losses exceed actuarial projections. The adjustment is triggered before Aggregate Excess insurance to help ensure the captive has adequate funding, provides member-to-member protection, and creates a greater incentive for members to prevent losses.

The second essential component in understanding how a group captive insurance program works is the captive's structural flow. The simplest way to illustrate the flow is to first look at a conventional insurance arrangement. With traditional insurance programs, an insured pays a premium to their broker, who in turn buys an insurance policy and services from a carrier on the insured's behalf. The conventional arrangement offers insureds little control over the carrier, any reinsurers it may use, the operating costs, claims management, and other essential insurance functions.

In a group captive insurance program, the structural flow is unbundled — offering the insured much more control over the services and better isolating the captive from volatile market conditions.

Here’s an overview of the major participants in a captive insurance program:

Stay up-to-date on the latest news and insights in the group captive industry by subscribing to Captive Resources.

Subscribe to Captive Resources

1Provisions also vary among the group captives supported by Captive Resources. Each captive’s program documents contain a complete statement of program terms that should be carefully reviewed.