It’s said that necessity is the mother of invention — an adage that’s proving especially true in today's commercial insurance market. As several factors fuel increases in the frequency and severity of claims, companies have been forced to look for alternatives to the inexorably rising costs of their conventional insurance plans — alternatives like captive insurance.

The drivers behind these increases and the captive insurance programs designed to address them were the focus of a recent article from Leader's Edge titled "Breaking the Cycle.” In the article, multiple industry professionals praised the ability of captive insurance to help companies escape a cycle of never-ending cost increases. Below are highlights of that article focused on the influence of group captives on insurance costs for mid-market companies.

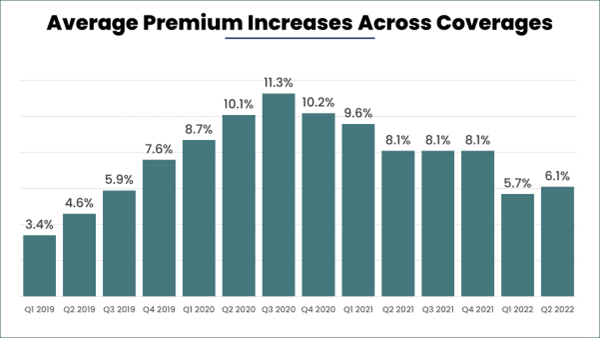

The trend of rising insurance costs is as pervasive as it is relentless. As we’ve detailed before, commercial insurance costs have been on the rise for some time — a testament to a significantly prolonged hard market that’s overwhelmed the market across coverage lines and account sizes.

The article touched on several cost drivers across coverage lines, including:

These drivers have increased both the frequency and severity of claims, prompting reinsurers to find ways to reduce their loss exposures. Namely, reinsurers have sought to increase the loss threshold at which reinsurance would take over, forcing insurance companies to retain more risk on their balance sheets. As those balance sheets start to swell, insurance companies relieve the pressure by increasing pricing and narrowing coverage terms and conditions, which shifts the burden to their insureds.

While these cost increases pose a serious issue for companies come renewal time, captive insurance in general — and group captive insurance for mid-market companies more specifically — has provided a reliable alternative.

“Necessity is the mother of invention,” said Nick Napolitano, Captive Practice Leader at AssuredPartners. “Given the sharp contraction in reinsurance market capacity, it’s more difficult to buy limits of insurance at a reasonable cost… When it is more difficult to buy limits of insurance at a reasonable cost, the use of captives increases.”

The reason behind the increased usage is reasonably straightforward: These situations are precisely what captive insurance was created to address. Here's a direct quote from Leader's Edge's article:

Given direct access to reinsurance markets, customized insurance protections, access to accrued investment income, and the incentive to improve loss control, captives are a proven way to insure challenging exposures that give pause to traditional insurance markets. Since the captive absorbs lower layers of loss, owners are able to buy excess layers of insurance and reinsurance at lower prices, much like having a higher deductible in car insurance.

While small increases in commercial insurance costs might not represent a substantial issue for mid-size companies, the seemingly perpetual cost increases we've seen in recent years have added up. Many companies have found a solution in group captives — whether heterogeneous group captives composed of companies from diverse industries; or homogeneous group captives comprised of companies from the same industry.

But group captives are not for every company. For instance, the model utilized by the group captives we support is best suited for companies with an entrepreneurial mindset that are very focused on safety. Still, we're nearing almost 6,000 member-insureds across the 43 group captives we support, proving the model can work for myriad companies.

In the article, Napolitano suggests that the growth of group captives may further complicate the commercial insurance market's issues as more “good risks” leave for greener pastures.

“There has been a mass exodus to the captive space, with the top 25 percent of performers shifting to a group captive,” Napolitano said. “This creates a situation of ‘adverse selection,’ where traditional markets insure what’s left. I’m not sure how much this meaningfully contributes to the current hard market, but intuitively it makes sense that it plays a role.”

If your company is looking to break the cycle of the hard market, contact Captive Resources to learn how a group captive can help you take control of your insurance program.

To read the full article from Leader’s Edge, click here to visit their website.