It’s official: The vast majority of companies save money when joining a group captive. This assertion comes from a recent analysis of roughly 1,000 bound policies of new group captive members in captives we support compared to the companies’ previous costs in the conventional insurance plans.

We created an infographic to highlight just how much typical members save. Fill out the form below to download your free copy.

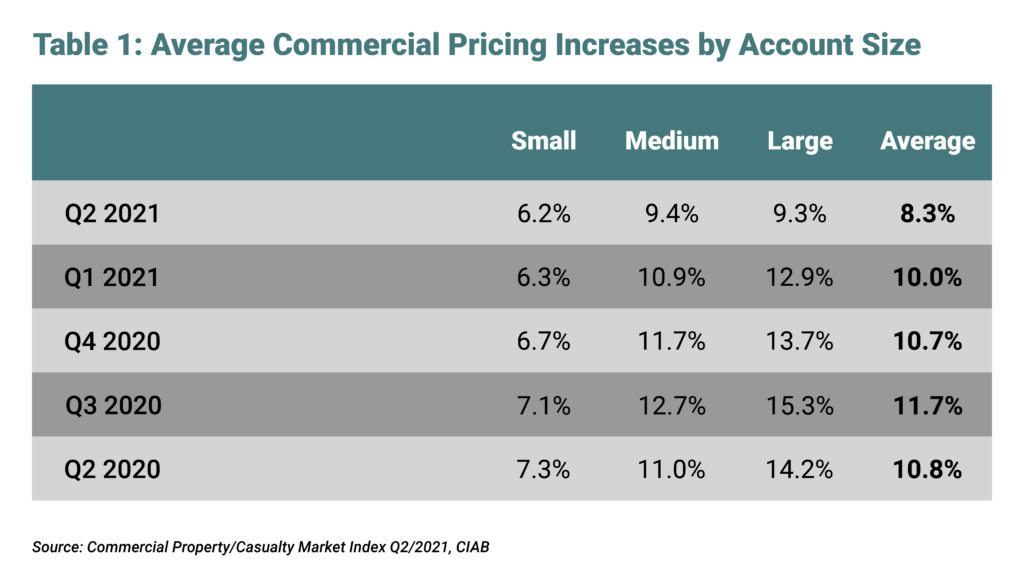

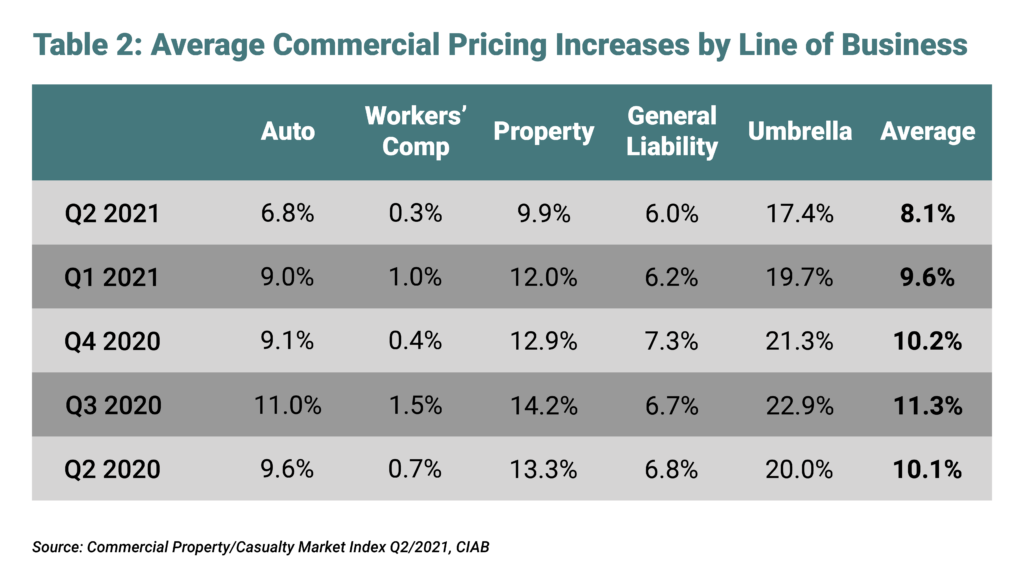

If you’ve noticed your company’s insurance premiums have continued to increase, you’re not alone. In Q2 2021, commercial insurance premiums increased for the 15th consecutive quarter, according to The Council of Insurance Agents & Brokers (CIAB). And these premium increases have been as sweeping as they have been persistent. Pricing increases have hit across all account sizes and major lines of coverage.

Group captive insurance offers companies a way to escape the volatility of the conventional market and take control of their insurance costs.

There are a lot of answers to this question, but they all revolve around a central theme: control. Group captives allow companies to transition from passive buyers of an insurance policy into active owners of an insurance company. All the group captives that we work with are owned and operated by the companies they insure, providing members several ways to control their total insurance costs.

In the infographic, we explore several reasons why new group captive members typically pay less than their previous conventional insurance plan, all of which are related to having ownership over the program. While we encourage you to download the infographic to get the full story, here are a few of those reasons:

Want to learn more about how joining a group captive could help your company address the rising costs of the conventional market? Contact Captive Resources today.

Want more great content like this? Subscribe to Captive Resources to get the latest news and insights in the group captive industry delivered straight to your inbox.